Fed Impact: When will interest rates go up?

With the Federal Reserve having discussions about raising interest rates to reduce the potential of greater inflation, there are quite a few questions about mortgage interest rates lately. The feeling in the market is one of uncertainty for a variety of reasons. Questioning when interest rates go up is something that economist and consumers alike are asking in the unknowns of the current financial and geo-political climates.

So… When will interest rates go up?

The truth is that there are few predictors of exactly when and if interest rates will go up. As the Fed discusses increasing the over-night rate for banks and lenders, there aren’t reliable indicators of how that will impact the interest rates available to consumers. However, we can look at what is true in the current market.

Let’s take a look at the facts of what we do know:

Mortgage Interest Rates are Still Historically Low

In 2021 mortgage interest rates hit all time lows. This made it an excellent opportunity to buy a home or refinance with a historically low interest rate mortgage. As of the time this article was published, interest rates are still near all-time lows.

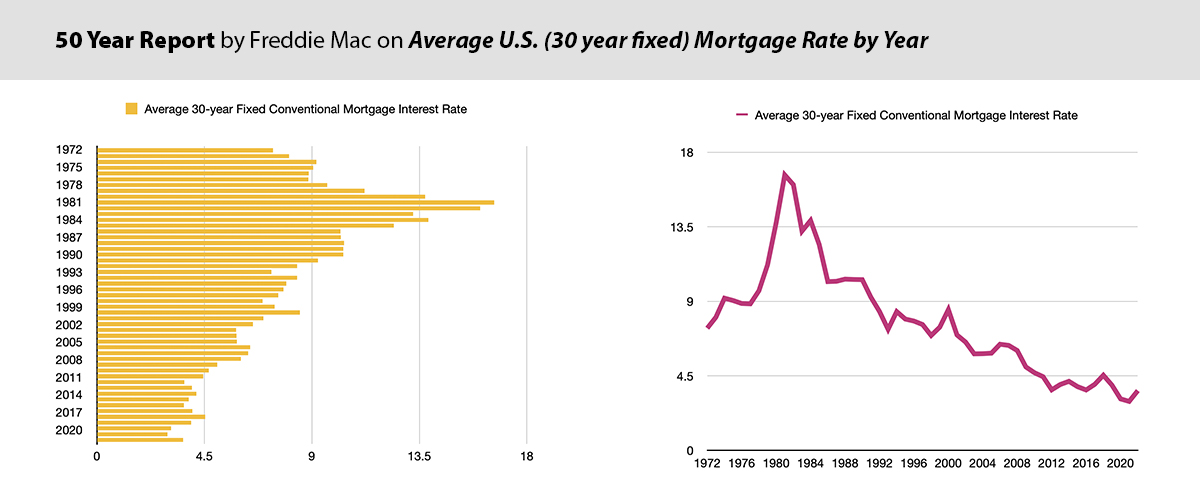

According to the data recorded by Freddie Mac over the last 50 years interest rates are comparatively low. Reaching the highest point in 1981, the average mortgage interest rate on a conventional 30 year fixed rate mortgage was 16.63%. During the month of October, the average interest rate was 18.45% in 1981.

The lowest average interest rate by year in the Freddie Mac Report is 2.96% in 2021. While the average (30yr fixed) interest rate in the the first two months of 2022 has risen above the lowest levels seen in 2021, this is still a great time to close on a mortgage.

Even by comparison to the last 30 years of data on the annual average interest rates, the current interest rates are low.

There are Good Reasons to Refinance or Buy a Home in the Current Market

Along with having interest rates near historic lows, there are other great reasons to consider your mortgage options in 2022. Whether you own a home or are looking to buy a home, the current market provides some advantages.

The the rapid increase home values over the last two years has provided homeowners with a unique opportunity for refinance options. 2022 could be a great time to refinance and drop mortgage insurance costs from an FHA or USDA loan with the market providing increased equity. Many homeowners are also utilizing the added equity in there home with a cash-out refinance.

If you are looking to buy a home. Now could be a good time to get away from the rising rent prices. While the cost of rental properties can increase with each lease agreement renewal, (usually annually) the principal and interest payment on a mortgage does not change for the duration of the loan term. So, while rental prices continue to increase with inflation, homeowners can have a more steady financial outlook in years to come.

We Offer Some of the Lowest Interest Rates Available

While we can’t fully answer the question… When will interest rates go up? We know that our goal remains the same. Our primary goal is to get you the best rate and mortgage option available to you on the current market. We will be happy to review the mortgage options that are specific to your needs and lock in the low rates that are still near historic lows.

Reach out to us for a customized quote!